Adjust/Close your Pseudo Market-Neutral Strategy Position

의사 시장 중립 전략 포지션을 조정/청산하십시오.

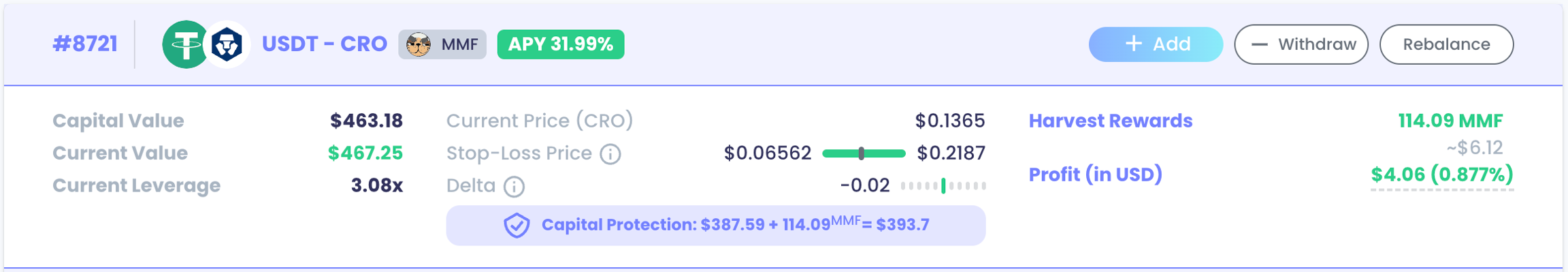

Add more collateral

Go to "My Strategy Positions" under Pseudo Market-Neutral Strategy

Click "Add" button

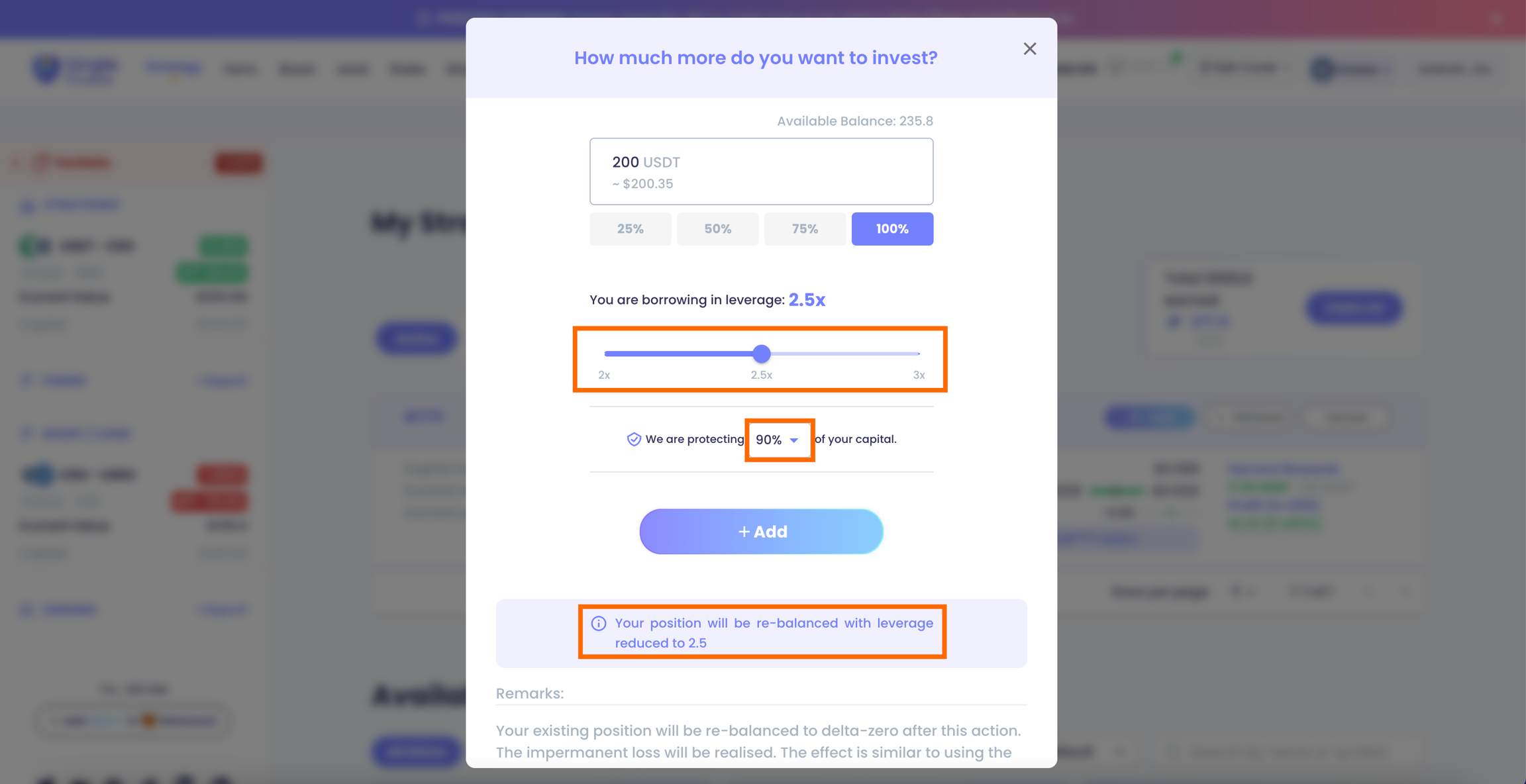

3. Add the amount of collateral you want to further deposit.

You could also update the desired leverage ratio and capital protection level of the existing position by completing this action.

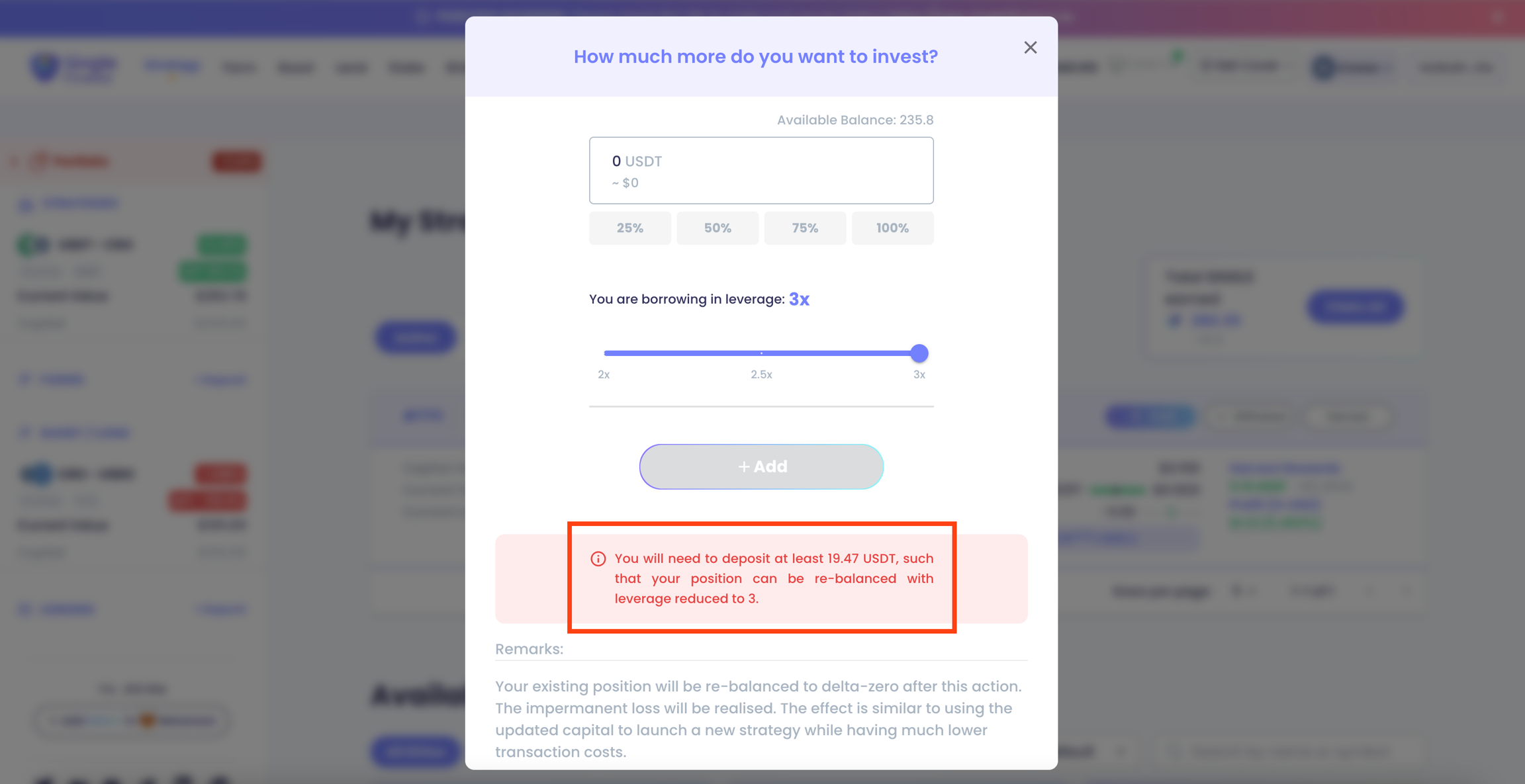

Note that if the current leverage ratio is higher than the allowable leverage ratio (3x), additional collateral must be supplied in order to complete the position adjustment. A reminding message will be shown as following.

4. Single Finance will re-balance your position after adding more collateral. Delta ratio of the whole position will be adjusted to zero after the change.

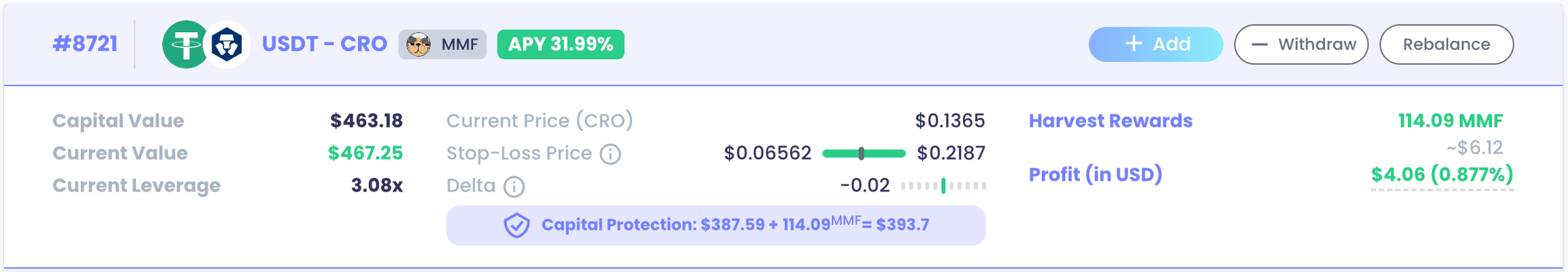

Close Position

Go to "My Strategy Positions" under Pseudo Market-Neutral Strategy

Click "Withdraw" button

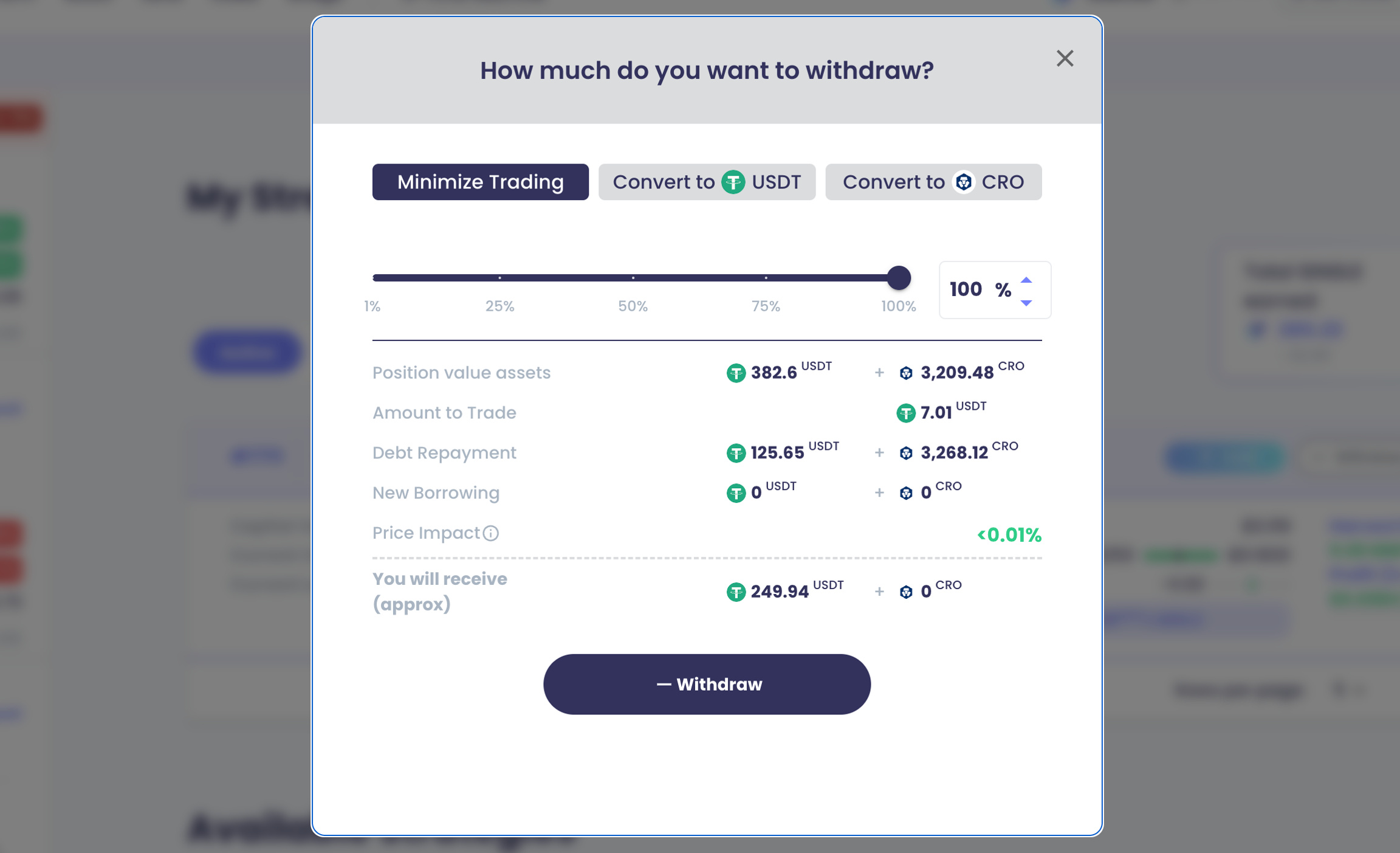

3. Choose the percentage of the position you want to withdraw and the mode of withdrawal you prefer.

a. Minimize Trading -> You can minimize the amount to trade with this mode. The transaction cost is the lowest among the three modes. But you may get both tokens instead of one.

b. Convert to Token A/B -> You would receive your selected token after our smart contract does the swap work for you. The transaction cost of the swap is charged by the DEX.

If you choose to withdraw 100%, the whole position will be closed. If the position value is close to US$200 (for Cronos) or US$100 (for Fantom) after withdrawal, the position could be easily capital-protected (i.e. position closed by our Capital Protection Bot and a $10 fee (for Cronos) or $5 fee (for Fantom) to be charged). As such, we do not allow any withdrawals that would result in a net value below US$200 (for Cronos) or US$100 (for Fantom).

4. Single Finance will re-balance your position after partial withdrawal. Delta ratio of the whole position will be adjusted to zero after the change.